Rupee gained in the early trade on Thursday by seven paise as it opened at 59.26 per dollar, compared to previous day's closing value of 59.33-a-dollar.

The gain was attributed to a four-month-low decline in Euro, close on the heels of European Central Bank meeting on Thursday that would stem more foreign capital inflows.

At the Interbank Foreign Exchange market, the local currency resumed lower at 59.40 as against the last closing of 59.38, and dropped later to 59.48 a dollar. However, it recovered further to 59.20 per dollar by banks and exporters, before settling down at 59.33 per dollar. It fluctuated in the range of 59.20 to 59.48 during the day.

Mohan Shenoy from the Kotak Mahindra Bank told Moneycontrol that currently global markets are focused on European Central Bank (ECB) rate settling meeting, where monetary relief is expected.

"This could weaken Euro and trigger flows into emerging markets. However, sterilisation of custodial flows by RBI is keeping USD-INR in a tight range. USD-INR is expected to trade today in a range of 59.20-59.50," Shenoy pointed out.

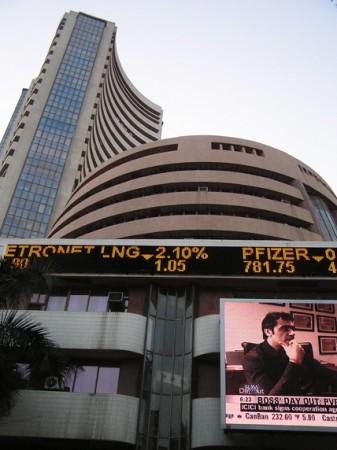

At 15:30 hours, Rupee declined to 59.2900, losing 0.04 points. Meanwhile, Sensex surged at 24,950.62 by gaining 150.78 points and Nifty touched 7451.25 by gaining 46.60 points.

BSE top gainers on Thursday trading hours are Sesa Sterlite, HUL, ONGC, Tata Motors and Hindalco. Besides, gainers in NSE are BPCL, Sesa Sterlite, HUL, Caim India and Jindal Steel.

"Dollar demand from importers forced rupee to trade low initially. However, it recovered at the end. Investors are being watchful ahead of US job data due later today," Pramit Brahmbhatt, CEO of Veracity Group told The Indian Express.

British Pound touched 99.6850 by slipping to 0.14 points at 15:30 hours. The Reserve Bank of India's monetary policy statement is scheduled on 5 August. The RBI has kept Repo rate unaltered at 8 percent, after monetary policy review on 3 June. If inflation rate slows faster than targeted, it would ease the monetary policy, according to RBI.

Major spurt in Rupee's value is expected when finance minister Arun Jaitley presents his budget in Lok Sabha, sometime in mid-July.