Billionaire industrialist Mukesh Ambani has sealed an Rs 13,000-crore deal to sell his East West Pipeline (EWPL) that owns the 1,400 km natural gas pipeline connecting Kakinada in Andhra on India's east coast with Bharuch in the western Indian state of Gujarat to Canadian investor Brookfield, media reports say.

Following the deal, the India Infrastructure Investment Trust (InvIT) in which Brookfield holds 90 per cent equity has filed a preliminary placement memorandum, through which InvIT-held Pipeline Infrastructure Private Ltd (PIPL) will invest Rs 13,000 crore to acquire EWPL.

Reliance Industries Ltd (RIL) will retain the right to acquire equity shares of PIP at an equity value of Rs 50 crore at the end of 20 years. RIL and PIPL have reworked the existing pipeline usage agreement giving significant participation in net earnings of PIPL to RIL, according to reports. "As part of the transaction, InvIT will acquire 100 per cent equity in PIPL, which currently owns and operates the pipeline," said a RIL statement.

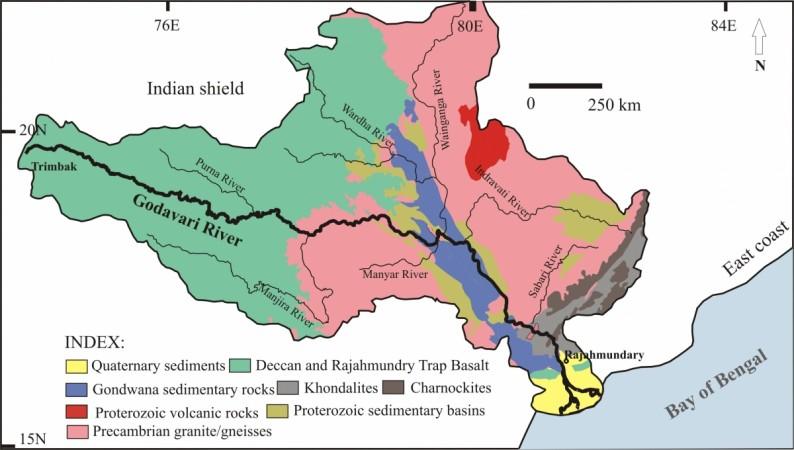

The pipeline had run into losses apparently because of a drop in natural gas production in Reliance Industries (RIL) blocks in the Krishna-Godavari basin. Following the production drop, the pipeline was running at nearly 5 per cent capacity to transport 80 mmscmd (million standard cubic metres a day) of natural gas, according to a report in the Business Standard.

Pipelines of several other operators like GAIL and Gujarat State Petronet connect to EWPL for onward delivery of gas to other parts of India. Under the deal, RIL will retain preference shares worth Rs 4,000 crore that it holds in PIPL which will be converted into equity after 20 years.

The pipeline project's future seems bright as it will be the key infrastructure of the KG Basin when three projects – R-Series, the satellite cluster and MJ (D55) – considered game changers for RIL and partner British multinational BP Plc start production in 2020. The two companies are investing about Rs 40,000 crore in the three projects that have discovered gas resources of around 3 trillion cubic feet.

The reworked usage agreement reduces the reserved capacity of EWPL to 33 mmscmd from 56 mmscmd. The deal stipulates that RIL will pay the difference between Rs 500 crore a quarter and the actual revenue PIPL earns against any unutilised capacity. RIL, however, will continue to be entitled to transport gas, either by itself or of any customer, free of cost against any outstanding unutilised capacity payments.

According to the agreement, RIL will not be liable to make unutilised capacity payments if the average volume of gas transported is 22 mmscmd at the current approved final tariff of Rs 71.66 per million metric British thermal units (MMBTU), the report says. The next tariff review is scheduled for April 2020.